Would you like to donate to the Kinsmen Foundation via TeleMiracle and are interested in reducing the cost of your next gift and potentially give more?

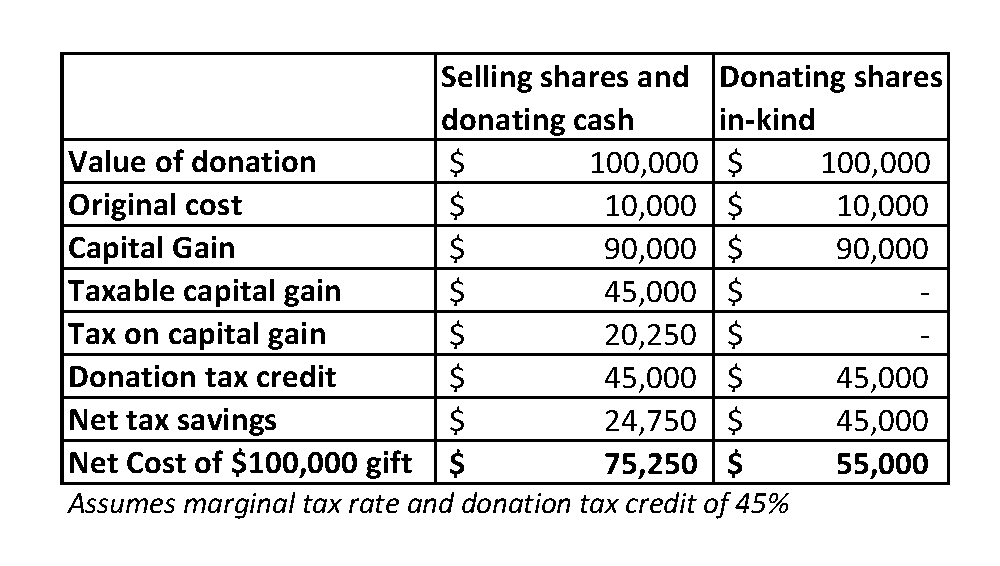

When you donate investments such as publicly traded shares or mutual fund units in-kind to the Kinsmen Foundation, you pay zero capital gains tax. That means you can receive significantly greater tax savings when donating shares rather than cash, as the following table shows.

Securities donated in-kind are valued based on the closing price the day the shares are legally transferred to the Kinsmen Foundation account.

To facilitate charitable share donations, please follow the instruction below:

- Complete the Charitable Donation Transfer Form.

- Send a copy of the form to your broker, investment advisor or financial institution as they are responsible for initiating the charitable donation transfer.

- Notify the Kinsmen Foundation Finance Manager, via the CONTACT US page, of the donation so you can receive an accurate tax receipt and be properly recognized for your donation.

Charitable Registration Number: 10757 1630 RR0001